The graph above recently appeared as part of Scott Walker’s Twitter feed. Presumably, the idea is to suggest that under Walker’s leadership, Wisconsin has done better than the country as a whole when it comes to unemployment, though an alternative version of the ad makes it somewhat more personal, using the same basic figures to suggest that Walker—a Republican presidential candidate—is outperforming sitting Democratic president Barack Obama. In these ads, the Walker campaign repeatedly highlights the fact that the unemployment rate in Wisconsin is lower than the national average. Note, however, that the unemployment rate in Wisconsin was already lower than the national average when Walker took office. In other words, Walker inherited a good labor market. If we want to measure Walker’s effect on the Wisconsin economy, we need to look at changes in the unemployment rate over time.

Category Archives: Statistics

Univariate distribution relationships

“Widespread failure to appreciate this distinction has wasted journal space, confused readers, and resulted in ‘solutions’ to phantom problems”

The quote above comes from Firebaugh and Gibbs’s “User’s Guide to Ratio Variables” (1985: 718). I first ran across this article a couple of years ago but only just got around to reading it this past week. This article, along with a couple of companion pieces (Firebaugh and Gibbs 1986; Firebaugh 1988), helped to redefine what was, at that point, a nearly century-old debate dating back to an 1897 article by Karl Pearson on ratio variables and the problem of spurious correlation. The gist of “Pearson’s Paradox” is that “two ratios can be correlated even when their components are not—for example, ![]() and

and ![]() can be correlated even when X, Y, and Z are not” (Firebaugh 1988: 524).* This basic fact became a point of contention among methodologists interested in, among other things, the best approach to controlling for population size when analyzing aggregate data in which the magnitude of a given outcome is at least partially driven by the size of the underlying units. While the debate itself is pretty interesting, the thing I liked best about the Firebaugh and Gibbs piece is the way in which the authors managed to clear away a significant amount of methodological underbrush using simple math.

can be correlated even when X, Y, and Z are not” (Firebaugh 1988: 524).* This basic fact became a point of contention among methodologists interested in, among other things, the best approach to controlling for population size when analyzing aggregate data in which the magnitude of a given outcome is at least partially driven by the size of the underlying units. While the debate itself is pretty interesting, the thing I liked best about the Firebaugh and Gibbs piece is the way in which the authors managed to clear away a significant amount of methodological underbrush using simple math.

Following Firebaugh and Gibbs (1986: 103), let’s start with a component-based model in which ![]() is a continuous outcome,

is a continuous outcome, ![]() is the predictor of interest,

is the predictor of interest, ![]() is a control representing the size of the population, and

is a control representing the size of the population, and ![]() represents a random disturbance:

represents a random disturbance:

![]()

If we then divide everything through by ![]() we end up with an equivalent ratio-based model:

we end up with an equivalent ratio-based model:

![]()

where ![]() . On its face, the equivalence of these two expressions seems obvious. Yet prior to the work of Firebaugh and Gibbs, much of the fight was over the difference between the component-based model described above and the following:

. On its face, the equivalence of these two expressions seems obvious. Yet prior to the work of Firebaugh and Gibbs, much of the fight was over the difference between the component-based model described above and the following:

![]()

Simply put, the fight was driven by an attempt to adjudicate between fundamentally non-comparable models, hence the reference in the title to wasted journal space, confused readers, and solutions to phantom problems.

What Firebaugh and Gibbs ultimately show is that when we compare the component method to the equivalent ratio method (i.e. when we make the correct comparison), we find alternative estimators for the same basic model. To the extent that ![]() —the variance of

—the variance of ![]() —is proportional to

—is proportional to ![]() (i.e. to the extent that the variance of the error term is characterized by a particular form of population-related heteroscedasticity), the ratio method actually provides more efficient estimates of the parameters of interest than the corresponding component method (see Firebaugh and Gibbs 1986).** So where we once saw a potential problem, we now see a potential solution.

(i.e. to the extent that the variance of the error term is characterized by a particular form of population-related heteroscedasticity), the ratio method actually provides more efficient estimates of the parameters of interest than the corresponding component method (see Firebaugh and Gibbs 1986).** So where we once saw a potential problem, we now see a potential solution.

Even if you don’t care about ratio variables, I think that the original piece, subsequent follow ups, and exchanges with critics (namely Bradshaw and Radbill 1987) are well worth the read. This is a great example of someone thinking through the problem of model specification, as well as the implications of the often overlooked distinction between specification and estimation. There is also a serious discussion of the relationship between theory and method. More specifically, Firebaugh and Gibbs go to great lengths to emphasize that, by definition, our theoretical interests cannot help us decide between mathematically equivalent expressions. The trick, of course, is recognizing equivalent expressions when you see them.

* Firebaugh (1988: 524-526) shows that Pearson’s Paradox is a byproduct of the fact that correlation coefficients do not account for the value of the ![]() -intercept. Pearson’s Paradox does not extend to the case of regression in which the intercept is explicitly taken into account.

-intercept. Pearson’s Paradox does not extend to the case of regression in which the intercept is explicitly taken into account.

** Nerdy readers may recognize the ratio method for what it is: a weighted least squares model.

What’s the matter with logistic regression?

As it turns out, logistic regression is much harder than it looks. Actually, the hard part is trying to compare the results of logistic regression across models. The basic gist of the problem is that the coefficients produced by a run-of-the-mill logistic regression are affected by the degree of unobserved heterogeneity in the model, thus making it difficult to discern real differences in the true effect of a given variable or set of variables from differences induced by changes in the degree of unobserved heterogeneity.

To see how this works, let’s imagine that the values of a given binary outcome ![]() is driven by the following data generating process:

is driven by the following data generating process:

![]()

where ![]() refers to an unobserved latent variable ranging from

refers to an unobserved latent variable ranging from ![]() to

to ![]() which depicts the underlying propensity for a given event

which depicts the underlying propensity for a given event ![]() to occur,

to occur, ![]() represents the effect associated with the

represents the effect associated with the ![]() th independent variable

th independent variable ![]() , and

, and ![]() represents an adjustment factor which allows the variance of the error term

represents an adjustment factor which allows the variance of the error term ![]() to be adjusted up or down.

to be adjusted up or down.

Since ![]() is unobservable, the latent variable model can’t be estimated directly. Instead, we take the latent variable model as a point of departure and treat

is unobservable, the latent variable model can’t be estimated directly. Instead, we take the latent variable model as a point of departure and treat ![]() —which we can observe—as a binary indicator of whether or not the value of

—which we can observe—as a binary indicator of whether or not the value of ![]() is above a given threshold

is above a given threshold ![]() . By convention, we typically assume that

. By convention, we typically assume that ![]() . If we further assume that

. If we further assume that ![]() has a logistic distribution such that

has a logistic distribution such that ![]() and

and ![]() , we find with a little bit of work that

, we find with a little bit of work that

![]()

This should look familiar—it is the standard logistic regression model. If we had assumed ![]() took on a normal distribution such that

took on a normal distribution such that ![]() and

and ![]() , we would have ended up with a probit model. Consequently, anything I say here about the logistic regression applies to probit models as well.

, we would have ended up with a probit model. Consequently, anything I say here about the logistic regression applies to probit models as well.

The relationship between the set of “true” effects ![]() and the set of estimated effects

and the set of estimated effects ![]() is as follows:

is as follows:

![]()

Simply put, when we estimate an effect using logistic regression, we are actually estimating the ratio between the true effect and the degree of unobserved heterogeneity. We can think about this as a form of implicit standardization. The problem is that to the extent that the magnitude of ![]() varies across models, so does the metric according to which coefficients are standardized. What this means is that the magnitude of

varies across models, so does the metric according to which coefficients are standardized. What this means is that the magnitude of ![]() can vary across models even when the the magnitude of the true effect

can vary across models even when the the magnitude of the true effect ![]() remains constant.

remains constant.

The implication here is that we can’t get away with the usual trick of comparing a series of nested models to determine the way in which the inclusion of controls affects the parameter estimates associated with a given variable of interest. Moreover, we can’t compare group-specific models unless we are willing to assume groupwise homoscedasticity. The latter principle also extends to the interpretation of interaction effects within a single model. In other words, unobserved heterogeneity can pose big problems in the context of logistic regression.

Perhaps somewhat surprisingly, discussion of this issue goes back at least as far as Winship and Mare (1984) who proposed a solution based on the use of a standardized dependent variable. Alternative solutions have since been proposed by Allison (1999), Williams (2009), and, most recently, Karlson et al. who have a paper forthcoming in Sociological Methodology. In addition to providing a nice overview of this line of work, Mood (2010) discusses a number of other solutions including the use of linear probability models. While the linear probability model is not without its problems, it is easy to estimate and interpret. Moreover, the problems that does have are often easily remedied without turning to logistic regression.

the potentially non-existent effect of disaggregation

What do we do when we think that a particular set of effects is likely to vary significantly across groups? There seem to be two basic approaches: we can either (a) run separate models for each group or we can (b) pool data across groups and then allow effects to vary through the inclusion of interaction terms (i.e. run a fully-interacted model). In terms of coefficients, the two approaches will ultimately produce equivalent results.* The standard errors, however, are a different story. This inevitably has implications for things like statistical significance, a subject with which sociologists in particular are known to be preoccupied.

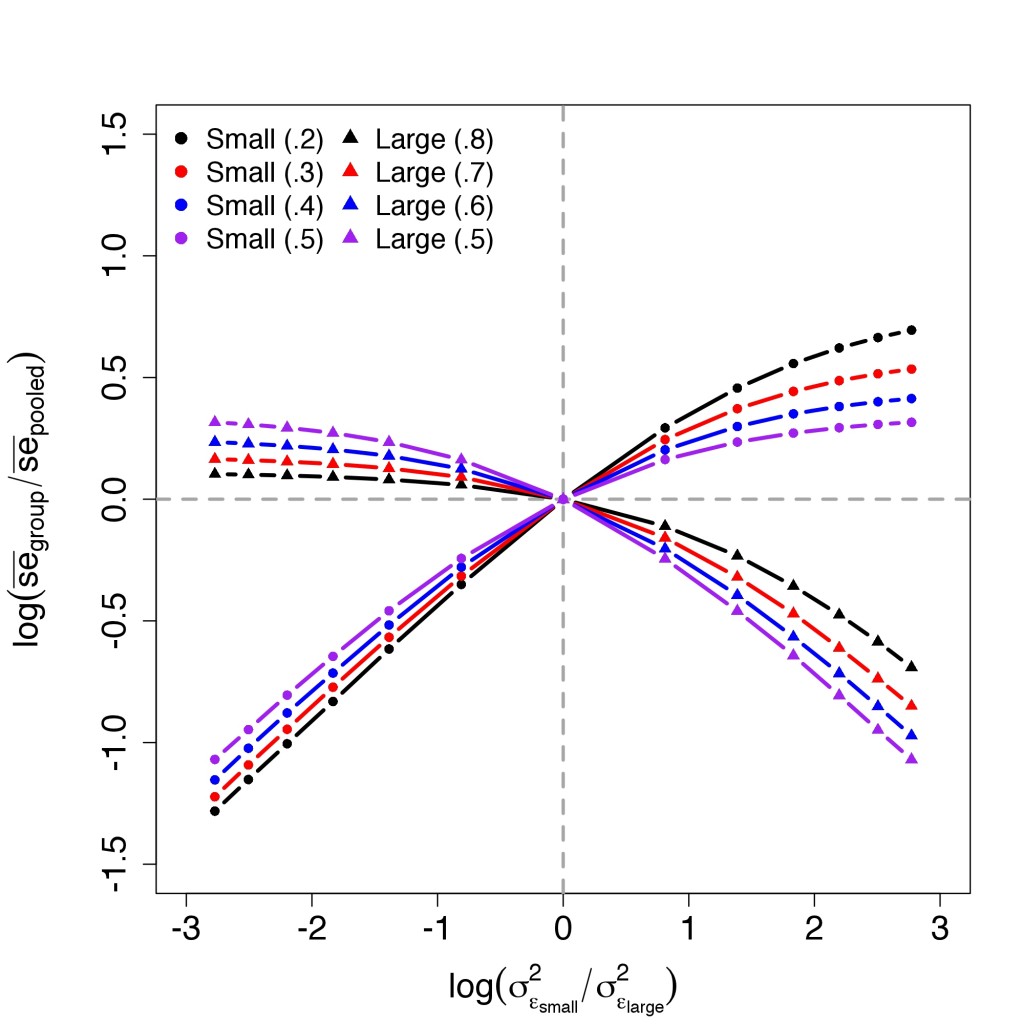

A common intuition is that these changes are due to changes in the degrees of freedom resulting from disaggregation. Having recently run into this suggestion in a couple of different places, I decided to make up some data to get a better sense of how standard errors are affected by groupwise disaggregation (i.e. running separate models for each group as opposed to running a single pooled model with a bunch of interaction effects). I was interested in particular in the way which the expansion and contraction of group-specific standard errors varies depending on differences in group size and error variance. The results of this experiment are shown in the graph below which, in effect, depicts the expansion and contraction of standard errors as a function of the level of groupwise heteroscedasticity. To anticipate the discussion below the break, the main finding here seems to be that, on average, disaggregation has no effect on standard errors in the absence of heteroscedasticity.**